Have you ever been thinking that your site supervisor knows nothing and you should run the site instead, or that HR messed up again and you could do a much better job managing the office? Of course I never thought that <cough>, but many friends or colleagues told me they had. But seriously, have you ever thought about starting to work for yourself, on your own terms, with you being in charge, while still doing what you love and what you know best – i.e. archaeology? If the answer is yes, then read on.

Setting up our own business as either a Sole Trader, Partnership or Ltd Company might seem difficult or even daunting at first, but is actually relatively easy in reality. Having said that, there are a few things that you need to seriously consider before taking the plunge, particularly whether the move from employment (with all its inherent faults, but also a number of real advantages) to self-employed status will be beneficial to you. To help you make the right decision, this article by Arte-facts looks at the process of setting up on your own based on their own experiences– describing the likely pitfalls and making useful suggestions to make the transition as easy as possible.

Self-Employment

Before launching into the intricacies of setting up your own business, it is perhaps useful to consider briefly what does it mean to be self-employed. In simplest terms, ‘self-employed’ person is anyone who is not employed by someone else. There are two choices within this fway of making a living– you can either set up as a Sole Trader or a Limited Company (even if it is just a one person company). Before deciding, which option best suits you, it is good to get business advice from your local council (they always have an department to help start-up businesses) or from an accountant.

The advantages and disadvantages of either option can be found clearly explained on this website. We have registered as a sole traders, as it suited our needs and it was very easy to set-up. To do this, you need to log in to HMRC website, where you get the Government Gateway on your email. You will need this to log in to the HMRC portal and register for Self Assessment by inputting the date your self-employment starts. You do not need to register at all if your self-employment income does not exceed £1000. The self-assessment has to be filled once a year by the 31st of January, which is also a deadline for the first tax payment on account, so make sure you do this well in advance, especially as the website can get busy at this time (see here for more information). [HK1] You must also make sure that you have enough money set aside to pay your tax.

Unlike the limited company, a sole trader can use their personal bank account, so you do not need a separate business account. However, be aware that this requires a lot of caution to keep the business and private transaction separate. It is probably better to get a business bank account as it will look more professional and will be easier to keep track of all your income and expenses.

Sorting out the financial/legal issues is difficult/boring/tedious/scary, but is important! We strongly recommend checking out the www.gov.uk website, where you will always find the most reliable and up to date information.

Self-Discipline

Perhaps, the biggest difference between being employed and self-employment is the level of responsibility, which increases exponentially when you start your own business. As a self-employed you are responsible for all aspects of your business, from insurance to tax. You are also responsible for constantly finding and/or tendering for jobs and finding new clientele to insure that you will have enough finance to carry on. Self-discipline is a key here, as by becoming self-employed you will cease to be under any obligation to get up in the morning and must try to structure your days at the ‘office’ rather than just while away the hours.!

Finance

It may be obvious, but no matter how much we love our job, unless we have some other source of income, we do it for money. No doubt, being employed by a company, with attached regular monthly salary, even a low one, gives us a natural sense of security. On the other hand, being self-employed always brings the risk of wavering cash flow and a potential lack of income. Another potential problem is the next year “payment on account” taxation– where at the end of each financial year you have to pay tax for the next year as well based on what you made the previous year. This can cause a serious cash flow problems, especially if your income varies from year to year . That said, this does not mean that being employed provides complete security against financial problems or a sudden loss of work either.

The low salary/income in Archaeology profession is one of the key reasons why people choose self-employment – while the employment security is reasonably similar, the money you earn as self-employed can be very different: compare minimal archaeologist salaries on the CIfA website and the daily rate estimation for a freelance MCIfA .

Regardless of the reasons for

setting up on your own, any business requires

sufficient funds to run efficiently and this includes daily subsistence needs

as well as household and work related expenses.

Equipment

A big investment (at least initially) is the equipment, which varies depending on the type of work your business is intending to carry out. For example, a field archaeologist, would require all the basic tools like a trowel, shovel, tapes, pens and pencils, but also other items like PPE clothing and stationary, including a stock of drafting film (formerly permatrace).

The financial costs may be limited somewhat if your (initial) plan is to work as a sub-contractor to a larger companies that are regularly needing temporary field archaeologists to supplement their core staff, especially on larger infrastructure jobs and similar. However, before accepting that ‘well-paid’ sub-contracting job, there is a raft of legal consequences to consider reading: CIfA Self Employed Status (Diggers Forum) and BAJR Guide to Self-Employment.

However, while you may be provided with all necessary equipment when working as a sub-contractor to another company (archaeology or developer), this may vary between companies and jobs and you will still need to be able to provide your own equipment etc.

Specialist Equipment and Business Premises

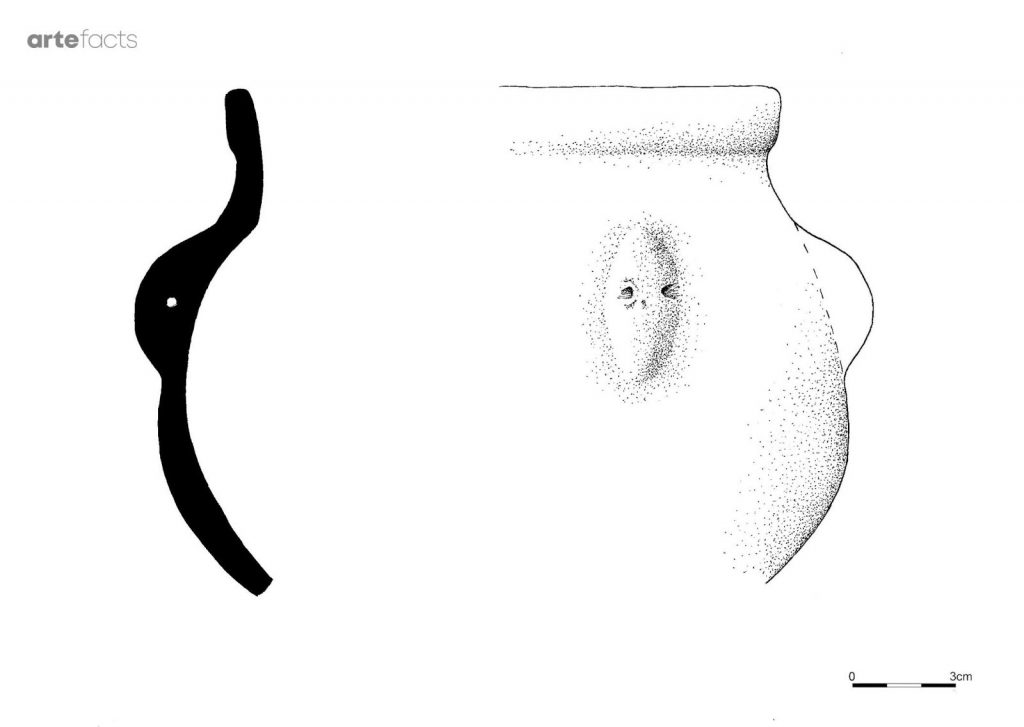

The equipment costs may be further extended by setting up a specialist company. For example, our Arte-facts company provides particular professional services related to post-excavation processing of artefacts– from finds photography (www.arte-facts.co.uk/portfolio) and specialist drawing to archiving. Therefore our equipment is different from that of field archaeologist. When we were setting up, we already had some necessary equipment, such as cameras. However, some we had to buy anew for which we had to use our savings, set aside as business funds.

Fortunately, due to the nature of our business, we didn’t have to hire/rent a separate business premises, but were able to create a home studio instead and thus save a lot of money. However, you should certainly consider whether you will need a separate business premises before setting up, as this will likely add a major further costs to your intended business.

Insurance

Insurance is a must for any self-employed person and also represents additional business expenses. The type you have to get will be dependent on the services your company will be providing within the contracting archaeology but Private Indemnity and Public Liability are the most common covers you may need. A lot of archaeology companies in UK use Towergate Insurance to get the right archaeological insurance, which can be tailored to suit your needs (remember that they may change over time). A simple guide to Insurance in Archaeology is available from BAJR Guide to Insurance:

Business Expanses and Tax deduction

Remember, we are not trying to discourage you from becoming self-employed by all these financial considerations and associated potential expenses. However, you should be aware of these and also of the fact that you can deduct business expenses from your future income tax return! The list of things and services you can deduct as self-employed can be found on the Government website: – which is the principal up to date source of information about self-employment in the UK.

Accountancy

Related to finances, it is absolutely crucial to keep all the receipts and invoices in good order. Some of you may be in a position to hire an accountant to deal with all your tax needs etc, however, in reality, most of us will have to deal with these ourselves. To do this, you have to be organised. This may mean different things to different people but you can find more detailed information and advice here. Based on our experience, best way to deal with receipts and related material is to scan them and put them into monthly folders to be stored as digital files in your computer. Make sure you scan both sides of receipts (if applicable) and have a back-up, such as external hard drive. You can also keep the original or print the receipts/invoices if you want to have a physical archive but there is no legal obligation to keep the original, provided you have the digital copies.

It probably might be useful to name the folders by the months of the purchase, and within the month folder, folders named by the type of expense, for instance: car and travel expenses, equipment, insurance, accountancy (if you have someone to do it for you), etc. You can also use some commercial apps for keeping the records, where you can only take a picture of the receipts. You can find a list of them here. That all is required to do the tax assessment at the end of the tax year, as this is something, what every self-employed need to do by THEMSELVES. Perhaps make a spreadsheet containing all your outgoing and incoming expenses/credits.

VAT

Unless your earnings exceed the VAT threshold (over £85,000 in 2019), you do not have to register or pay VAT. However, you do not have to go over to register for a VAT, should you find it of benefit, as you can claim VAT back on all your business purchases. The benefit is that you can reclaim VAT on all business purchases; the disadvantage is you must charge VAT, however, if most of your clients are VAT registered, they can reclaim it, so it does not really make you more expensive. Consider whether your expenditures (purchases) will be sufficient to make this worthwhile, as by becoming VAT registered you will also have to be even more organised, keep more detailed records and fill in the VAT return every three months. VAT return is now all digital and there are multiple ways, softwares and online systems that you can use (some free)– e.g. VitalTax which creates a bridge to your VAT account, works out what you owe and even submits it for you!

Reaching Clientèle

In archaeology, as we all know, personal contacts and recommendations provide the best route to clients and work. However, it is useful to reach a wider audience especially if none of your friends or existing contacts need your services. One way is to advertise on specialist websites, such as BAJR’s Specialist Finder, which is where freelancers like myself and my finds illustrator and a lithics specialist colleague can be found. However, it is also essential to create a website, with a proper portfolio of your work and skills.

Getting online

In all honesty, apart from using Google and Facebook, we never had much experience with internet stuff and due to limited resources, we couldn’t hire a professional to create our website. We were forced to adapt and learn fast. Initially, a friend-of-a-friend was supposed to ‘help’ us with the website; they recommended a few options, but then didn’t have enough free time to finish this, so we ended up with a domain, hosting and a website from completely different providers and without a clue, how to connect them together. We would strongly discourage you from taking this route.

Eventually, we created the website, on a free platform, which took longer than anticipated, but now the business can be found easily online: www.arte-facts.co.uk

Whatever your expertise or type of services you provide, I would strongly advise any budding self-employed archaeologist to create your own website in order to reach wider audience and potential clients. This can be your online business card containing more information about you, what you have done, what skills you have and more.

To support the website, you can link to a social media: www.facebook.com/arte.facts.post.ex/ ; www.linkedin.com/company/arte-facts-post-ex . And remember, treat followers as friends and they will help you create a positive image of the company, friendly yet professional.

Recap

- Making a decision: Do you really want to go down this route?

- Research the options available (sole trader, partnership, Ltd Company etc)

- Do some financial calculations regarding start-up costs and monthly expenses

- Consider Insurance

- Accountancy: Get your Tax and VAT sorted

- Reaching clients and promoting your company: creating website and social media profile

- Work hard and know you are the boss, your business will be as good as you are.

If you have questions relating to setting up a small business in the UK (or just like what we do) you can contact us via email: info@arte-facts.co.uk or personal LinkedIn profile: www.linkedin.com/in/krawczyk-malgorzata/ .

Malgorzata Krawczyk.